A look at 3 timely transfer pricing topics

Global intangibles, intercompany financing and SALT

Guy Sanschagrin, CPA/ABV, MBA, WTP Advisors, Minneapolis | June/July 2022 Footnote

Editor's note: Updated May 25, 2022

Since the late 1990s, transfer pricing has been recognized by many as the No. 1 international tax issue multinational companies face. Ernst & Young’s 2021 Transfer Pricing Survey highlights the following as key forces driving transfer pricing challenges for multinational companies:

- Global tax reform.

- Global supply chain reconfiguration.

- The rise of controversy and changes in enforcement behavior.

- Digital transformation.

Sixty-five percent of survey respondents said they expect the number of transfer pricing audits to increase in the next three years. Sixty-one percent said they will likely change their approach to transfer pricing in the coming two years.

Transfer pricing is the price paid in a transaction between related or controlled parties such as affiliated corporate entities. Since these transactions do not involve participants that are independent from one another, they are not subject to normal free-market forces. Thus, companies need to deliberately set the prices of intercompany transactions.

For companies operating in multiple countries or U.S. states, transfer pricing can cause organizations to underpay (or overpay) income tax in jurisdictions. This creates exposure to double taxation — and nondeductible penalties and interest — associated with potential transfer pricing adjustments.

Controlled transactions typically involve the sale of goods, license or sale of intangible property, services and financing (e.g., loans).1 Most tax authorities require companies to engage in controlled transactions at arm’s length as if they take place between unrelated parties.

Conceptually, to meet the arm’s length standard, related parties must demonstrate their controlled transactions take place under the same terms and conditions as third parties. In practice, this means companies would apply one or more transfer pricing methods to establish or test the arm’s length nature of their controlled transactions and prepare documentation support.

This article addresses three timely transfer pricing topics that impact companies operating across borders:

- Global intangibles and risks.

- Intercompany financing.

- SALT transfer pricing.

These topics universally impact companies ranging from entrepreneurial businesses operating in multiple U.S. states or entering new international markets to the largest companies with complex value chains spanning the globe. Each of these topics can be the subject of standalone articles.

Global intangibles and risks

For most companies, intangibles are their most valuable assets. In fact, intangible assets were estimated to make up 84% of all enterprise value on the S&P 500.

2 Such intangible property (IP) includes legally protected intellectual property, such as patents and trademarks. But often a company’s most valuable IP goes far beyond legally protected intellectual property, including proprietary technology, designs and know-how, software and global customer relationships.

Many companies perform research and development (R&D) and other functions that create IP in several jurisdictions. If a company operating across jurisdictions is not careful, they can create a lack of clarity with respect to the entity or entities who own the IP. This can create situations in which the authorities of different tax jurisdictions can claim right to tax additional profit associated with the IP.

For example, a U.S. company charged its foreign affiliate for a share of R&D costs and charged a royalty for licensing the use of the same IP. The R&D charge effectively transferred ownership of the associated IP to the foreign affiliate. Because the foreign affiliate funded the R&D, it becomes an owner of the IP and should not pay a royalty charge for the use of the IP it owns.

It’s important for a company to maintain a transfer pricing policy that clearly defines which entities own the company’s intangible property — and these IP owner entities should fund and manage IP development. This becomes increasingly challenging with globalization and the mobile workforce. Often, a company might decide to centralize the ownership of its IP in a single entity. An IP owner entity will often contain the functions to manage and protect the assets.

3

Other companies might decide to have their country entities own their individual rights to the IP. Still others might decide to implement a regional IP ownership approach.

4

In addition to maintaining a transfer pricing policy that clearly defines the IP owner entity or entities in the company’s global value chain, it is also important to identify the entities that use IP. There are several ways for which an IP owner can receive compensation for licensing the right to use IP to affiliate entities. One common approach is to license its use in exchange for a royalty. Other approaches might entail different types of charges or a bundled approach with services or tangible goods transactions. It is important to consider the profit level of the IP user entities under such an approach. For instance, a company should likely reconsider charging a royalty that causes the IP user entity to operate at a loss.

Intercompany financing

Companies frequently provide funding and other financial support among affiliates. Intercompany financing transactions include loans, cash pooling, financial guarantees and factoring arrangements. These transactions are receiving more scrutiny. The Organisation for Economic Co-operation and Development (OECD)

5 recently released substantial guidance to determine and evaluate the arm’s length pricing of controlled financial transactions.

Loans are the most common type of intercompany financing. One of the main issues associated with intercompany loans is the appropriate characterization of the transaction. For example, a company transmitted $1.5 million to its Canadian affiliate intended as a loan. However, the company failed to put in place a loan agreement with payment terms and an arm’s length interest rate. Two years later, the Canadian affiliate had yet to pay any principal or interest. At this point, it becomes apparent that the transaction looks more like a capital contribution rather than a loan — a situation that may give rise to unfavorable tax consequences.

When determining an arm’s length interest rate for an intercompany loan, the OECD has provided guidance on the characteristics that should be considered. The below table illustrates a comparison of some of these the characteristics between two loans.

| Characteristics |

Loan A |

Loan B |

| Credit rating |

BBB |

BBB |

| Currency |

USD |

JPY |

| Maturity |

1 year |

10 year |

| Rate type |

Fixed rate |

Floating rate |

| Seniority |

Subordinated |

Senior |

| Collateral |

Non-secured |

Secured |

The characteristics in the first column impact the degree of risk associated with each loan. The OECD guidance specifically requires companies to analyze the impact of each loan characteristic and associated risks. Many transfer pricing analysts use data, such as Bloomberg, to determine a range of arm’s length interest rates. Additional tools are emerging to help companies establish arm’s length transfer pricing. For instance, Accurate™ is a robust, cloud-based software solution companies can use to perform the analysis and prepare supporting documentation.

6

State and local tax (SALT) transfer pricing

Most finance and tax professionals think of international transactions and multinational companies when the subject of transfer pricing comes up. However, transfer pricing plays an important role in state and local tax for many companies operating in the United States. U.S. states generally apply one of three major alternatives for formulary-apportioned corporate tax reporting: separate reporting, combined reporting and consolidated reporting.

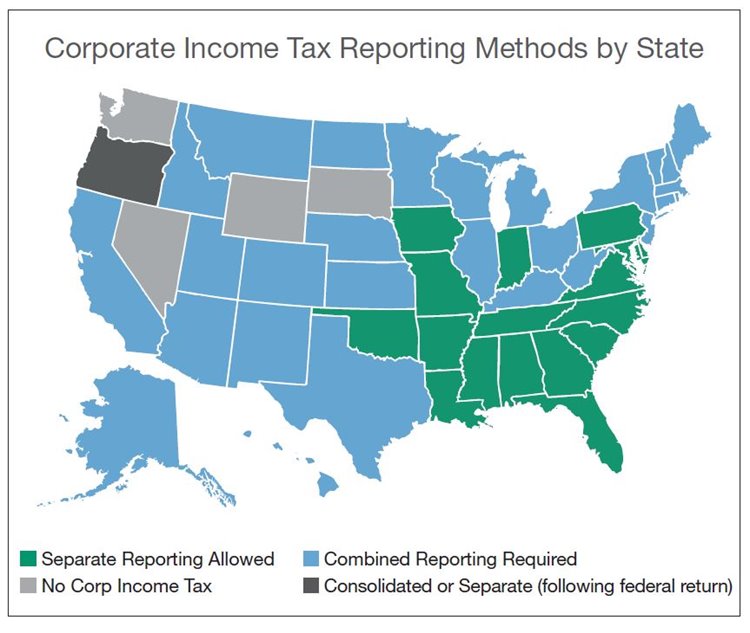

States set a requirement for one type of filing and often allow taxpayers to elect and petition to file using an alternate reporting method. The map on this page provides a general representation of the default reporting methods among the states.

7

U.S. domestic transactions can affect state tax liabilities, particularly for taxpayers in states that file separate returns for each in-state corporation. These states, highlighted in green on the map, require intercompany transactions to take place as if they occur between unrelated entities. Because separate reporting generally starts with a corporation’s federal income calculated on a separate-company basis, the taxpayer’s separate company taxable income will be affected by the pricing of transactions between the taxpayer and any out of state domestic affiliate or foreign affiliate.

Intercompany transactions are eliminated in combined and consolidated return states. However, these combined reporting state tax authorities, highlighted in blue on the map, may review transactions between related domestic and foreign entities, particularly in water’s-edge filings in which intercompany transactions are not eliminated. Transfer pricing issues can also arise when there are transactions between two or more unitary groups that share common ownership.

Many states, such as Indiana, North Carolina and Louisiana, are very active in transfer pricing — even hiring transfer pricing specialists. Moreover, the Multistate Tax Commission recently relaunched its State Intercompany Transactions Advisory Service (SITAS) to support states. SITAS has circulated an Information and Exchange Agreement that is akin to the information sharing agreed to by various countries.

8 As such, it behooves U.S. companies to evaluate the adequacy of their domestic transfer pricing.

9

Companies should act expeditiously

Perceived higher priorities and deadlines might tempt a company to ignore transfer pricing or delay taking action to develop or update its transfer pricing policy and risk management program. Companies that procrastinate face the risk of adjustments that cause highly unfavorable tax consequences — including double taxation and nondeductible transfer pricing penalties.

10 Upon request from the tax authority, typically documentation must be provided within a relatively short period.

11

More importantly, the absence of transfer pricing documentation shifts the burden of proof from the tax authority to the taxpayer. This means that without transfer pricing documentation and intercompany agreements in place, the tax authority has a blank slate with which to make transfer pricing adjustments. Such adjustments are typically substantial. This situation also places the taxpayer at a substantial legal disadvantage; it is costly to appeal transfer pricing adjustments and much more difficult to do so successfully.

Just because a tax authority has not questioned a company’s transfer pricing during prior audits does not mean they will accept the company’s transfer pricing in the next audit. A company made the mistake of assuming the IRS accepted their transfer pricing in an audit. The following year, when the IRS requested the company’s transfer pricing documentation, the company was empty-handed. The IRS then had a blank slate that they used to propose multimillion-dollar adjustments to increase taxable income in the United States. The company then faced an uphill battle to counter the IRS’s entrenched position.

Many companies have established internal teams to manage global transfer pricing in-house. There are courses that are available to professionals to advance their knowledge of transfer pricing. For example, the University of Minnesota’s Master of Business Taxation (MBT) program offers a semester course on transfer pricing. There are technologies designed to support company efforts to manage their global transfer pricing. One example is TransPortal — a global transfer pricing management platform designed to organize, manage and facilitate transfer pricing processes.

12

While many companies have gone to great lengths to put in place robust transfer pricing policies, processes and documentation — others procrastinate due to other perceived higher priorities. These companies should act expeditiously to evaluate their risks and develop transfer pricing policies and support to reduce risks of double taxation and non-deductible penalties. Investment and focus on transfer pricing now will help companies avoid potential high costs and disruption from controversy with tax authorities later.

Guy Sanschagrin leads WTP Advisors’ transfer pricing and international valuation practice and is CEO of TransPortal, a global transfer pricing management platform. He is also an adjunct professor teaching transfer pricing at the University of Minnesota’s Carlson School of Management. You may reach him at +1 866-298-7829 ext. 702 or guy.sanschagrin@wtpadvisors.com.

1 Other types of controlled transactions can and do take place.

2 https://tinyurl.com/Intangible-Assets

3 For example, R&D managers, software development directors, marketing executives and IP attorneys. The OECD has introduced guidance with respect to the need to carefully identify Development, Enhancement, Maintenance, Protection and Exploitation (DEMPE) functions associated with IP as an integral part of the transfer pricing analysis.

4 It is common for large multinational companies to establish regional Europe, Middle East, Africa (EMEA) and Asia Pacific region IP owners.

5 OECD is heavily involved in promulgating guidance on transfer pricing to foster global cooperation among tax jurisdictions.

6 See https://tpaccurate.com/.

7 This map is subject to change.

8 See https://tinyurl.com/SITAS-agreement

9 For more on SALT Transfer Pricing, search online for “SALT Transfer Pricing — What You Need to Know: Parts 1 and 2” by Doug Schwerdt, Guy Sanschagrin and Bill Lunka published in Tax Notes State on Jan. 24 and Jan. 31, 2022.

10 The U.S. and many other countries have instituted transfer pricing penalties applicable to companies that fail to maintain transfer pricing documentation.

11 For example, 60 days (Germany), 30 days (US) and 14–16 days (the Netherlands).

12 https://www.trans-portal.com/