Beneficial Ownership Information Resources

Updated: April 22, 2024 | New article and FAQs

The Beneficial Ownership Information (BOI) framework, established under the Corporate Transparency Act (CTA) of 2021, requires the disclosure of BOI data to the Financial Crimes Enforcement Network (FinCEN).

This initiative empowers FinCEN to gather and distribute beneficial ownership details to law enforcement agencies, financial institutions, and authorized entities, thus enhancing transparency and reducing opportunities for individuals to conceal or profit from illicitly acquired assets.

As of Jan. 1, 2024, FinCEN started requiring BOI reports. Noncompliance includes substantial civil and criminal penalties.

This page will be continuously updated with new information as it becomes available.

Who needs to report?

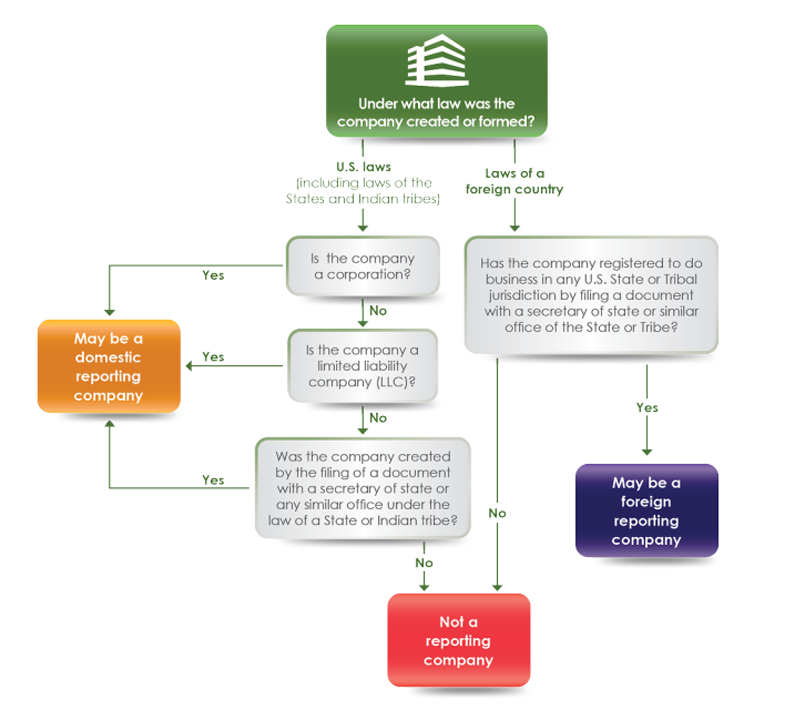

Companies referred to as “reporting companies” will be required to report their beneficial ownership information to FinCEN. There are two types of reporting companies — domestic reporting companies and foreign reporting companies.

There are 23 types of entities that are exempt from the reporting requirements. Carefully review the qualifying criteria before concluding that your company is exempt.

See this flowchart and more in the

Small Entity Compliance Guide

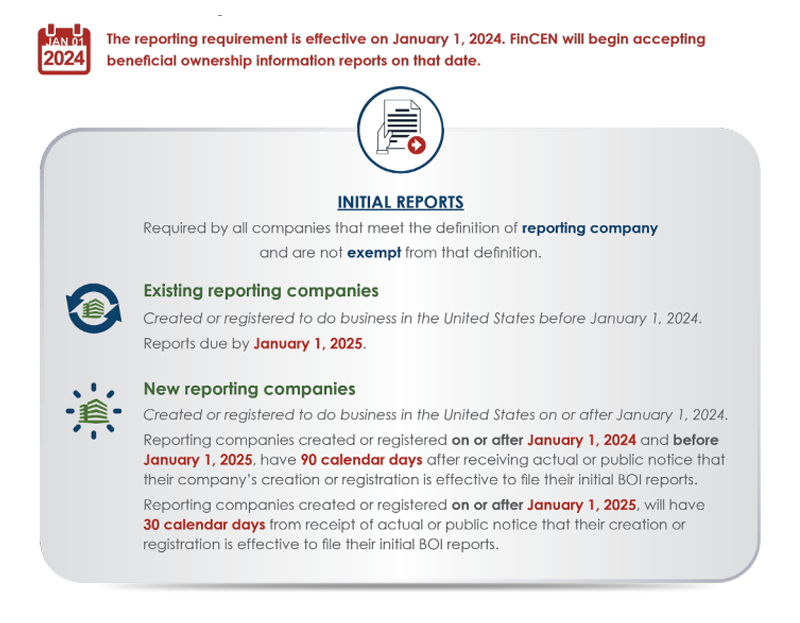

When do you need to do something?

The reporting requirement is effective Jan. 1, 2024. FinCEN will not accept BOI reports before then.

See this timeline and more in the

Small Entity Compliance Guide.

What information do companies need to report?

- Full legal name of the reporting company or any trade or DBA names.

- Business address.

- State or Tribal jurisdiction of formation or registration.

- IRS TIN.

- Information about its beneficial owners, and for newly created companies, it’s company applicant(s), including: name, birthdate, address and unique identifying number and issuing jurisdiction from an acceptable identification document.

Are there penalties for noncompliance?

- Civil penalties are up to $500 per day that a violation continues.

- Criminal penalties include a $10,000 fine and/or up to two years of imprisonment.

Articles and resources

See more BOI CPE options