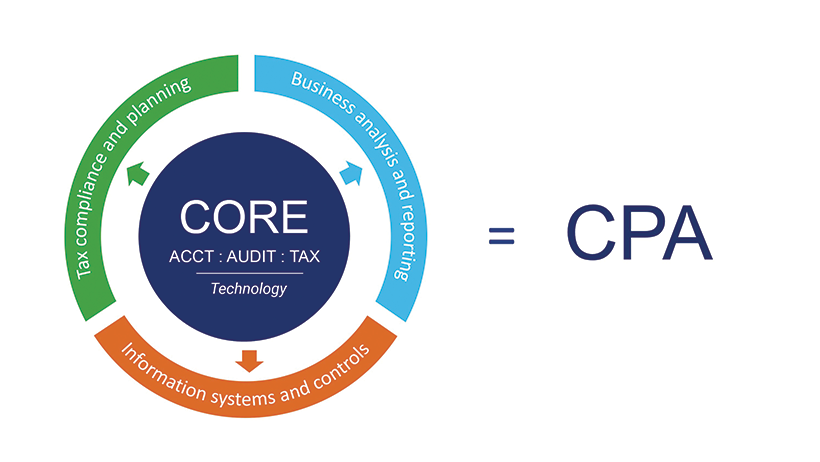

2024 CPA Exam Evolution: Core-Plus-Discipline Model

The new CPA licensure model requires CPA candidates to be skilled in accounting, auditing and tax. These sections will remain as core, required subjects. Technology questions will be spread throughout these sections.

In addition to the core exam sections (accounting, auditing and tax), CPA candidates will need to select and pass one of the following three discipline sections:

- Business Analysis and Reporting (BAR) – Assurance or advisory services, financial statement analysis and reporting, technical accounting, and financial and operations management.

- Information Systems and Controls (ISC) – Assurance or advisory services related to business processes, information systems, information security and governance, and IT audits.

- Tax Compliance and Planning (TCP) – Advanced individual and entity tax compliance.

Contact us

Contact the MNCPA membership team at 952-831-2707 or membership@mncpa.org with questions about the CPA exam.