Minnesota paid sick and safe leave

An employers guide for compliance

Larry Morgan, MAIR, SPHR, SHRM-SCP, GPHR | August/September 2023 Footnote

Editor's note: Updated April 10, 2024

On May 24, 2023, Gov. Tim Walz signed the Minnesota Earned Sick and Safe Leave (ESSL) Act into law. The law mandates employers of all sizes to provide paid leave for employees experiencing personal or family medical issues, time off for medical treatment, diagnosis, issues regarding domestic abuse, stalking, legal meetings and so forth.

The ESSL provisions — effective Jan. 1, 2024 — do not preempt other local paid sick and safe time laws but are similar to those already in effect in the cities of Bloomington, Duluth, Minneapolis and St. Paul. All the ordinances differ slightly, so employers must be aware of the details if they have employees working in those areas. If the local law provides a more generous benefit, it should be offered. Conversely, the ESSL should be followed if it is more generous.

Who is covered?

ESSL covers all employees (including part-time and temporary employees) performing work for their employer in Minnesota for at least 80 hours in a year. Employers with one or more employees are required to follow the law. It does not cover independent contractors or certain individuals employed by an air carrier as a flight deck or a cabin crew member. Employees may use ESSL once they have performed at least 80 hours of work in Minnesota in a year. All employees working at least 80 hours within the state become eligible after the 80 hours, but accruals should begin on day one of employment following Jan. 1, 2024.

How much sick and safe time can employees earn?

An employee earns one hour of sick and safe time for every 30 hours worked and can earn a maximum of 48 hours each year under the ESSL provisions unless the employer agrees to a higher amount.

At what rate must sick and safe time be paid?

Sick and safe time must be paid at the same hourly rate an employee earns when they are working.

What can sick and safe time be used for?

Employees can use their earned sick and safe time for these reasons:

- The employee’s mental or physical illness, treatment or preventive care.

- A family member’s mental or physical illness, treatment or preventive care.

- Absence due to domestic abuse, sexual assault or stalking of the employee or a family member.

- Closure of the employee’s workplace due to weather or public emergency or closure of a family member’s school or care facility due to weather or public emergency.

- When determined by a health authority or health care professional that the employee or a family member is at risk of infecting others with a communicable disease.

Which family members are included?

Employees may use earned sick and safe time for these family members:

- Their child, including foster child, adult child, legal ward, child for whom the employee is legal guardian or child to whom the employee stands or stood in loco parentis (in place of a parent).

- Their spouse or registered domestic partner.

- Their sibling, stepsibling or foster sibling.

- Their biological, adoptive or foster parent, stepparent or a person who stood in loco parentis (in place of a parent) when the employee was a minor child.

- Their grandchild, foster grandchild or step-grandchild.

- Their grandparent or step-grandparent.

- A child of a sibling of the employee.

- A sibling of the parents of the employee.

- A child-in-law or sibling-in-law.

- Any of the aforementioned family members who share that relationship with an employee’s spouse or registered domestic partner.

- Any other individual related by blood or whose close association with the employee is the equivalent of a family relationship.

- Up to one individual annually designated by the employee.

What additional sick and safe time resposibilities do employers have?

In addition to providing their employees with one hour of paid leave for every 30 hours worked, up to at least 48 hours each year, employers are required to:

- Include the total number of earned sick and safe time hours accrued and available for use, as well as the total number of earned sick and safe time hours used, on earnings statements provided to employees at the end of each pay period.

- Provide employees with a notice by Jan. 1, 2024 — or at the start of employment, whichever is later — in English and in an employee’s primary language if that is not English, informing them about earned sick and safe time.

- Include a sick and safe time notice in the employee handbook, if the employer has an employee handbook.

- Not engage in retaliation for employees using qualified ESSL time off.

The Minnesota Department of Labor and Industry will prepare a uniform employee notice that employers can use and will be available in the five most common languages spoken in Minnesota. Employers will be required to post the notice at worksites in an area normally visible to employees.

Can I require medical certification before approving the leave?

Employers may request medical certification for employees out for three or more consecutive days. Also note potential additional certification issues for American Disabilities Act Amendments Act or Family Medical Leave Act.

How does the ESSL program integrate with existing sick leave, vacation and paid time off (PTO) programs?

If the employer provides paid time off, vacation, sick leave or programs allowing the employee to take time off for the ESSL reasons stated previously and the time off meets or exceeds the ESSL requirements, they will be compliant with the statute. Note that once the employee has used the time off for vacation, illness or personal reasons, no additional time must be granted under the statute. Employers should keep accurate records of employee use of these programs.

What about collective bargaining agreements?

Nothing in the ESSL statute should be construed to limit the right of parties to a collective bargaining agreement to bargain and agree with respect to ESSL policies or diminish the employers’ obligation to comply with any contract, collective bargaining agreement or employee benefits provided the minimum standards in the statute are met.

The ESSL provisions may be waived by a collective bargaining agreement with a bona fide building and construction trades labor organization. Such waiver must reference the ESSL law and clearly and unambiguously waive application of the relevant sections.

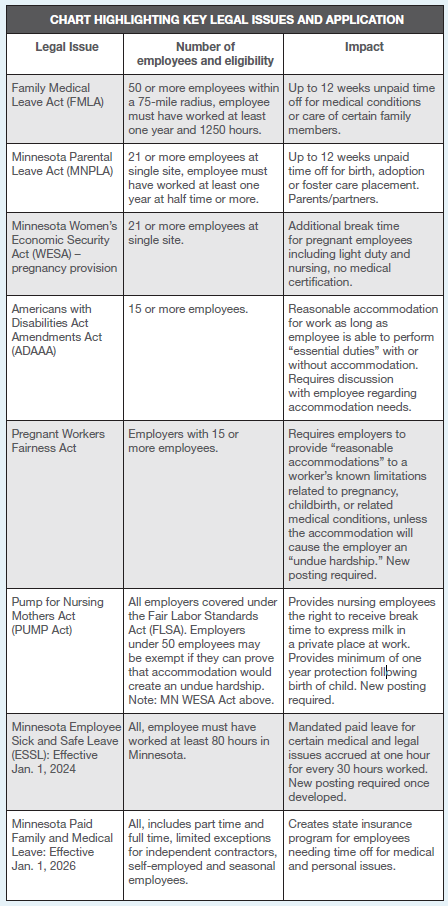

Will it integrate with workers compensation, shortterm disability programs, Family Medical Leave Act, Minnesota Parental Leave Act, Americans with Disabilities Act Amendments Act (ADAAA) Pregnant Worker Fairness Act and PUMP Act?

Interfaces may occur depending on employer size and certain qualifying issues based on the eligibility criteria. Employers should carefully evaluate employee requests based on specific facts and circumstances to determine if multiple areas are involved, document the issues carefully and apply the most generous (and often multiple program designations). Documentation and designation of the leave should be completed as needed for compliance purposes.

What is the impact on employee benefit eligibility?

Employees should maintain existing benefits, including employee contribution toward benefits. Employees would also be eligible for benefit changes during annual enrollment periods consistent with other employees.

Carryover provisions

An employer must permit an employee to carry over accrued and unused ESST to the following year. At no time can the employee have more than 80 hours of designated and unused ESST unless allowed by the employer. An alternative to providing carryover into the following year, an employer can provide the employee with ESSL for the year that meets or exceeds the 48-hour minimum that is available for immediate use at the beginning of the year (front loading) as either:

- 48 hours, if an employer pays an employee for accrued but unused ESSL at the end of the year.

- 80 hours, if an employer does not pay an employee for accrued but unused ESST at the end of the year.

Pay out upon termination requirements

There is no requirement to pay out accrued and unused ESSL if the employee terminates. However, if the employee is reinstated within 120 days following layoff or termination, the employee balance of ESSL will be reinstated.

Confidentiality, retaliation, employment reinstatement

Employers must maintain employee privacy on the reasons for leave to the extent possible. Employers are prohibited from retaliation for employees using ESSL and employees must be reinstated to their same or equivalent position following return of approved ESSL.

Time tracking and statement of earning requirements

Employee time off taken for ESSL reasons should be tracked and recorded including updates on pay stubs or statement of earnings.

How does this interface with the 2026 Minnesota Paid Family and Medical Leave law?

The Minnesota Paid Family and Medical Leave law does not go into effect until Jan. 1, 2026. The law will require a payroll tax of 0.7% on employee earnings and up to 50% of the tax may be shared with employees. There will be a new state agency developed to administer the leave plan, which will pay a percentage of the employee wages based on income. The ESSL could provide up to 48 hours of leave time in a 12-month period unless the employer agrees to more. The Minnesota Paid Family and Medical Leave law would provide up to an additional 12 weeks of paid leave. Prior to when it goes into effect in 2026, the law may undergo changes.

Employer tips

- Amend sick leave or PTO programs as needed.

- Train managers on the provisions of ESSL.

- Work with payroll provider to track time designated as ESSL and add onto payroll stubs or statement of earnings with each paycheck.

- Establish a definition of “12-month annual plan” dates; employers may designate a calendar year, fiscal year or employee anniversary date.

- Amend employee handbook information as needed.

- Watch for technical corrections, Q&A, required posting from the Minnesota Department of Labor and Industry.

- Reach out to the MNCPA HR Hotline or legal counsel as needed.

Adapting to change

Adapting to new laws can be daunting for employers and employees alike, but keeping track of the ins and outs of the new ESSL Act will make for happier, healthier humans. At the end of the day, that will lead to better outcomes for your organization.

Larry Morgan, MA, SPHR, SHRM-SCP, GPHR, is the president of Orion HR Group and frequent MNCPA instructor and author. He is also the expert behind the MNCPA HR Hotline. Morgan brings more than 40 years of HR experience to the MNCPA in areas that include retail, high-tech, manufacturing and financial services.