Overview of the Domestic Content Bonus Credit

By Andrew Nlemadim

April 25, 2024

As part of Minnesota's ambitious clean energy initiatives, the Domestic Content Bonus Credits provided by the Inflation Reduction Act (IRA) of 2023 represent a significant opportunity to further enhance the state's renewable energy projects.

If your clients include manufacturers that produce components for solar, wind, geothermal, battery storage — or if your clients have other clean energy projects or businesses that are investing in clean energy initiatives within Minnesota (or considering doing so) — it is crucial to alert them to the Domestic Content Bonus opportunity.

This program offers a substantial opportunity for manufacturing clients to reduce the costs associated with their clean energy projects significantly.

Where does Domestic Content Bonus Credit come from?

The Inflation Reduction Act (IRA) broadened and extended several tax incentives for clean energy projects by modifying sections 45 and 48 of the Internal Revenue Code.

It also introduced new sections 45Y and 48E. These updates help facilitate the shift of the private sector toward more sustainable energy sources. A notable feature is the introduction of a "base amount" for these incentives, which can be increased fivefold when projects comply with new wage and apprenticeship requirements.

This ensures fair wages for construction workers and engages certified apprentices through U.S. and state labor departments. This increase is part of various bonus incentives available to energy projects, such as the Energy Communities Bonus Credits for projects in certain disadvantaged areas, and the Domestic Content Bonus Credits for those using domestically sourced materials and manufactured components.

The guidance issued on May 12, 2023, offers detailed directions for applying these Domestic Content Bonus Credits, marking a significant advancement in their implementation, though questions remain regarding some specifics.

These bonus credits aim to augment the benefits under sections 45 and 48 of the Code, offering a 10% boost for production and up to a 33% increase for investment credits, contingent on meeting specific criteria, including the wage and apprenticeship standards or qualifying for certain exemptions.

Qualifying for the Domestic Content Bonus

To qualify for the Domestic Content Bonus Credit as detailed in the Notice, your client’s project must be recognized as an "Eligible Project" and must meet each of the three criteria below:

- The steel or iron criterion.

- The manufactured products criterion.

- A certification requirement.

An eligible project is generally one that qualifies for the production or investment tax credits, covering facilities eligible under sections 45 or 45Y, energy projects under section 48, or investments related to qualified facilities or energy storage technologies under section 48E.

To meet the criterion, specific components of the project must be classified as either steel or iron or Manufactured Products. This distinction is crucial because the standards for manufactured products are more flexible than those for steel or iron.

A phased approach is used and manufactured products are considered domestically produced once a certain percentage threshold is met.

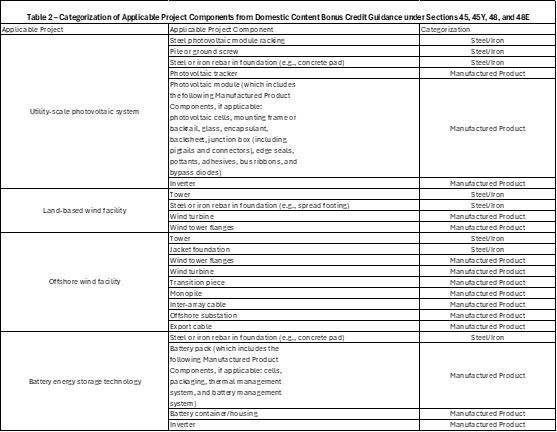

The notice provides a provisional list (Table 2) of common items and components used in energy projects, categorizing them as iron/steel or manufactured products. However, this list is not exhaustive and may not cover all pertinent products or subcomponents, particularly for emerging technologies eligible for the tax credits.

Acknowledging these gaps, the guidance suggests the Treasury is willing to consider alternative methods to the provisional list.

The intention behind these bonus credits is primarily to promote the development of new renewable energy facilities, although retrofitted facilities may also be eligible, provided they meet similar standards to the existing criteria for production and investment tax credits.

The notice applies the established 80/20 Rule to retrofitted facilities, which allows for eligibility if the market value of the reused property in the facility does not exceed 20% of the facility's total value.

1. Steel or iron requirement

The requirement for steel and iron in domestic content specifies that the manufacturing of all structural steel and iron must take place within the United States, except for certain metallurgical processes involved in steel refining.

This requirement is in accordance with sections 661.5(b) and (c) of 49 CFR and is specifically targeted at Relevant Project Components referring to construction materials predominantly made of steel or iron with a structural role.

This rule does not apply to steel and iron parts, or sub-parts, used in manufactured products, which are instead governed by the more flexible Manufactured Products Requirement.

2. Manufactured products requirement

The Manufactured Products Requirement for renewable energy projects introduces flexibility, requiring a specific portion of the facility’s total manufactured product cost to be attributed to items mined, produced, or manufactured in the U.S.

This is determined by the Domestic Cost Percentage, which compares the cost of U.S.-sourced products and components against the total manufactured products costs. Compliance is based on meeting a set threshold.

Costs for U.S. Manufactured Products and Components include:

- Essential manufactured products for the project.

- U.S. mined, produced, or manufactured components of foreign products.

All manufacturing processes for a component to be considered a U.S. component must occur in the U.S.

Further, mined components must also be U.S. sourced. Cost assessments focus on the direct materials and labor costs within the U.S.

The regulation emphasizes direct manufacturing costs for eligibility under the Domestic Content Bonus Credit, promoting U.S. manufacturing and avoiding broader production and resale rules.

The requirements become stricter over time with the necessary U.S. content starting at 40% for projects initiated before 2025 and increasing to 55% for projects commenced after 2026.

For offshore wind projects, the requirement begins at 20% for projects before 2025 and rises to 55% for projects initiated after 2027, gradually boosting domestic production in renewable energy.

3. Certification requirement

To be eligible for the Domestic Content Bonus Credit, taxpayers must include a Domestic Content Certification Statement with Form 8835 (Renewable Electricity Production Credit), Form 3468 (Investment Credit), or any relevant forms at the time of their yearly tax submission.

Furthermore, they are obligated to follow the recordkeeping requirements specified in section 6001 of the Internal Revenue Code to demonstrate their adherence to these guidelines.

Statutory elective payment phaseouts, as outlined in Section 45(b)(10) of the Inflation Reduction Act (IRA), determine applicable percentages for credits under § 45 based on various criteria, including facility size and construction timing.

Exceptions, such as the Increased Cost Exception and the Non-Availability Exception, allow for deviations from these requirements if certain conditions regarding domestic content are met. Similar rules and exceptions apply to credits under Sections 48(a)(13), 45Y(g)(12), and 48E(d)(5), reflecting the framework established for § 45(b)(10).

Minnesota's commitment to renewable energy sources, such as wind, solar and battery storage technologies aligns with the IRA's incentives for domestically sourced materials and manufactured components.

By adhering to the IRA's criteria, including the Steel or Iron Requirement and the Manufactured Products Requirement, Minnesota's projects can ensure compliance with federal standards and support local manufacturing and job creation.

Conclusion

The Domestic Content Bonus and other renewable energy credits are as valuable for your business as they are for your community.

Just know the rules are complex and the penalties for erroneous filing can be steep. Make sure you have an experienced guide by your side to help you qualify.

Andrew Nlemadim MBA, is a director at Tri-Merit Specialty Tax Professionals