R&D Tax Credit — Section 174 Updates

By Phil Williams and Nick Pantaleo

July 31, 2023

When the Tax Cuts and Jobs Act was passed in December of 2017, one of the legislative changes that received little attention was the requirement that all Section 174 (R&E) expenses should be capitalized and amortized over a 60-month (domestic) or 180-month (foreign) period starting Jan. 1, 2022. The rationale was that pay as you go (PAYGO) budget rules had to be followed and there had to be a tax increase to offset the tax cut that lowered the top U.S. corporate rate from 35% to 21%. Because R&E expensing and the R&D Tax Credit (Section 41) had broad bipartisan appeal, they were viewed as easy provisions to fix down the road.

Not exactly.

Fast forward to the 2023 tax season. Multiple opportunities to overturn the harmful legislation have fallen through the cracks and many practitioners and taxpayers are left wondering what their next steps should be. Most firms have advised their clients to extend their returns and to make extension payments and quarterly estimates under the assumption that the legislation will not change. However, they were still waiting for more guidance from the IRS or hoping for a retroactive change.

The American Institute of Certified Public Accountants (AICPA) has also been asking the IRS for clarification about many items, including the calculation of indirect costs, along with examples of which expenses should be included in “incident to development” and how broadly Congress intends them to be. With roughly two months until the September 15 filing deadline, there isn’t much time to wait.

With that in mind, how do you move forward and which assumptions can you make for your clients?

Here is a brief table comparing Section 174 activities to Section 41 activities and what to look for and identify with each:

The good news for businesses is that there are multiple instances of the Section 174 fix being included in proposed legislation with bipartisan support. There are several proposals in process. However, despite bipartisan support for Section 174, it continues to be utilized as a bargaining chip. In what amounts to a political staring contest, nobody seems ready to blink — at least not just yet.

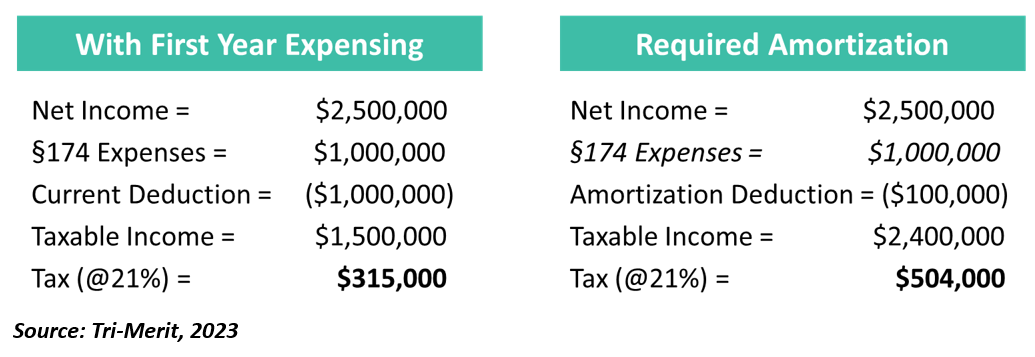

Whereas Congress and others regard 174 capitalization as a “timing issue,” the real-world effect on small businesses is staggering. Here’s an example:

The damaging effect on the business in the example is not significant because the business is profitable and is structured as a C-Corporation. However, suppose the business wasn’t turning a profit? Suppose it had a $900,000 increase in taxable income and was taxed as a flow-through entity? In that light, it’s easy to see why this legislation has garnered bipartisan agreement to overturn. But taxpayers are currently left without remedy because of political infighting.

Section 41 is a great tool for partially offsetting the impact of the required Section 174 capitalization. However, while every Section 41 eligible expense is a 174 expense, not every 174 expense is Section 41 eligible. A deep dive into the expenses and appropriate categorization is needed to ensure compliance, while also not unnecessarily capitalizing expenses that fit into one of the specific exceptions to Section 174. These exceptions include:

- Acquisition of an existing patent, model, product or process.

- Acquisition of land or depreciable property.

- Testing or quality control.

- Efficiency surveys.

- Management studies.

Outside of congressional action, the IRS needs to provide guidance on the appropriate calculation of indirect Section 174 expenses, which elements of software development need to be included and whether the funded research exception applies.

This guidance was unofficially expected this spring but has yet to be released. In the interim, taxpayers and practitioners must find the most viable path to follow. Tri-Merit has assisted taxpayers with complex and engineering-based tax issues since 2007. The firm offers assistance with Section 41/174 determination and documentation, cost segregation, renewable energy incentives under the Inflation Reduction Act, Section 179D energy efficient commercial building deductions, Section 45L residential energy credits, and the Employee Retention Tax Credit.

Phil Williams, JD, BSME is a Partner at Tri-Merit. He has worked with more than 350 companies in identifying, calculating, documenting and defending R&D credits at both the federal and state levels.

Nick Pantaleo is a Partner and the Chief Financial Officer at Tri-Merit.