Latest peer reviews show continued improvement

Trends, common deficiencies and areas of focus

Diana L. Weddigen, CPA, Lewis, Kisch & Associates, Ltd. | December 2022/January 2023 Footnote

Editor's note: Updated November 29, 2022

As a profession, we continue to adapt to a complex and constantly changing environment. In the past year, this has included pandemic funding, economic uncertainty, working remotely, changes in auditing standards and accounting standards updates. In this ever-evolving environment, we must stay current and continuously improve our professional competencies. In doing so, we maintain the trust and confidence placed in our profession.

The overall objective of the MNCPA peer review program is to promote and enhance quality in the accounting and auditing services provided by firms, in service of the public interest. Peer reviews are also an educational process, keeping firms apprised of changes in auditing and accounting standards and prevailing trends.

The MNCPA is responsible for the administration of the peer review program for Minnesota and North Dakota firms. Firms that perform attestation engagements are required to undergo a peer review every three years.

Firms are required to have either an engagement review or a system review depending on the level of services a firm performs. The MNCPA Peer Review Committee has compiled the results of engagement reviews and system reviews from the past three years to analyze trends and highlight areas for continued improvement.

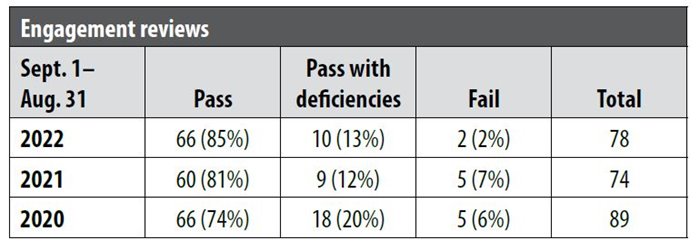

Engagement reviews

Firms that only perform services under Statements on Standards for Accounting and Review Services (SSARS) or services under the Statements on Standards for Attestation Engagements (SSAEs), that do not require system reviews, are eligible to have engagement reviews.

In the past few years, the percentage of firms receiving pass reports on engagement reviews has steadily increased. In order to keep this trend going, it’s important to be aware of deficiencies commonly noted during these reviews. These include:

- Accountant’s reports not being presented in accordance with current professional standards.

- Omission of statements referred to in accountant’s reports.

- Failure to document analytical procedures, including expectations, in review engagements.

- Missing engagement letters and representation letters.

- Material departures from GAAP without report modification.

- Missing financial statement disclosures.

- Failure to adopt ASC 606, Revenue from Contracts with Customers, or omitting required disclosures.

- Omission of disclosures in preparation engagements.

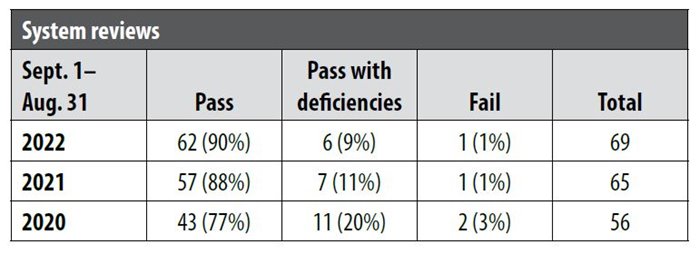

System reviews

Firms that perform engagements under Statements on Auditing Standards (SASs) or Government Auditing Standards, examinations under SSAEs, or engagements under PCAOB standards as their highest level of service must have system reviews. A system review includes reviewing a firm’s system of quality control for its accounting and auditing practice.

Similar to engagement reviews, there is an encouraging upward trend in the percentage of pass reports.

Common deficiencies noted in system reviews include deficiencies in the design or compliance with tone at the top, human resources and engagement performance, resulting in:

- Personnel not obtaining appropriate CPE and/or knowledge to perform engagements.

- Noncompliance with risk assessment standards.

- Incomplete audit documentation and evidence.

- Quality control policies and procedures lacking sufficient detail to comply with professional standards.

- Lack of compliance with Yellow Book CPE requirements.

Let’s keep increasing the positive peer review trends and enhancing quality in our profession. The following are some areas of focus as we continue to adapt and improve:

- SSARS 25 explicitly establishes that in review engagements, the accountant should determine materiality for the financial statements and apply this materiality in designing and evaluating analytical procedures. The standard also requires a new sentence in the review report that the accountant is required to be independent of the entity.

- SAS No. 136, Forming an Opinion and Reporting on Financial Statements of Employee Benefit Plans Subject to ERISA, requires new forms of the auditor’s report.

- Funding related to pandemic aid and relief may result in several thousand new single audits or other engagements performed under Government Auditing Standards. These engagements are highly specialized, with applicable AICPA standards and additional requirements issued by the U.S. Government Accountability Office (GAO). If you are considering performing a single audit for the first time, make sure you have sufficient and appropriate CPE and have the necessary competencies to perform the engagement.

- Ensure that risk assessment in audit engagements includes:

- Identification and evaluation of significant risks and the risk of material misstatement and response thereto.

- Assessment of risk at both the relevant assertion level and financial statement level.

- Evaluation of the design and implementation of internal controls relevant to the audit.

- When auditing accounting estimates in the current environment, scope should include the collectability of accounts receivable, recognition of bad debts and revenue recognition, including performance obligations, variable consideration and the time period for recognition.

- There is a new suite of Quality Management (QM) Standards that affect every firm with A&A engagements. Statement on Quality Management Standards (SQMS) No. 1 is required to be designed and implemented by Dec. 15, 2025, and a firm must evaluate its system of quality management by Dec. 15, 2026 (within one year of implementation). It will take firms some time to implement the new QM standards, so make sure to start early. The new QM Standards include:

- SQMS No. 1, A Firm’s System of Quality Management.

- SQMS No. 2, Engagement Quality Reviews.

- Statement on Auditing Standards (SAS) No. 146, Quality Management for an Engagement Conducted in Accordance with Generally Accepted Auditing Standards.

- SSARS No. 26, Quality Management for an Engagement Conducted in Accordance with Statements on Standards for Accounting and Review Services.

Maintaining momentum

As we continue adapting to our changing environment, let’s keep the upward trend in pass rates going, while enhancing the quality of our work and strengthening our profession.

Diana L. Weddigen, CPA is a partner with Lewis, Kisch & Associates, Ltd. She has more than 16 years of experience in public accounting, providing assurance and advisory services, specializing in the nonprofit sector. Diana is the MNCPA Peer Review Committee chair and has been a committee member for six years.

Bookmark the MNCPA SQMS Resources page

www.mncpa.org/SQMS

This resources page will be continuously updated leading to the Dec. 15, 2025, implementation dates for the new quality management standards.